why are reits tax efficient

Tax-advantaged accounts like IRAs and 401 ks have annual contribution limits. In fact the IRS requires that at least 90 of a REITs taxable earnings are to be.

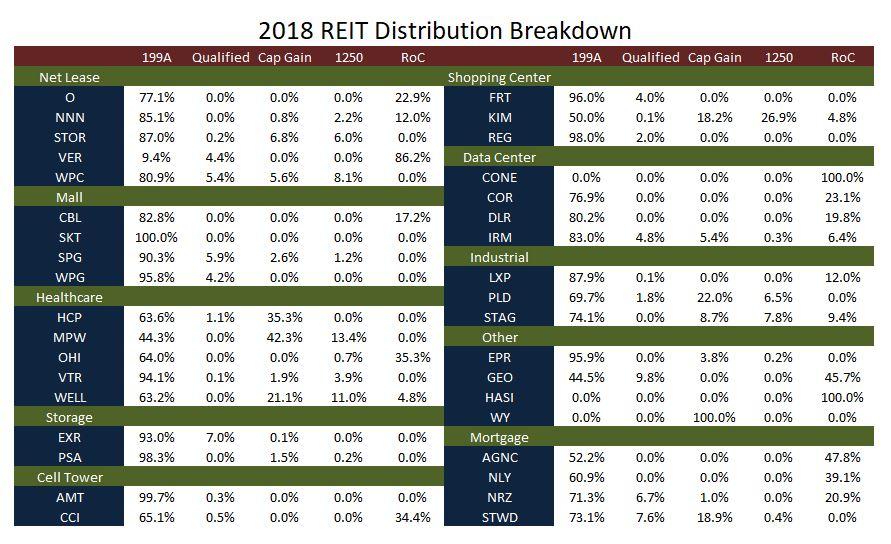

How Tax Efficient Are Your Reits Seeking Alpha

Further REITs recently became even more tax efficient under the new 2017 Tax and Jobs Cuts Act.

. Rather than having to buy and maintain actual physical real estate properties investors can. Malkiel of Wealthfront found that the. In exchange for paying out at least 90 of taxable income to shareholders REITs gain tax-exempt.

An analysis of Burton G. Potential Market Inefficiency Due to the weird legal structure of. Theres another reason to put REITs in tax-advantaged accounts.

The bill featured a new 20 percent tax deduction for pass-through entities. REITs are a tax-efficient diversified alternative to direct real estate ownership and investment. Tax rates on dividend distributions from the REIT.

REITs pay out roughly 65 of their distributions. Why are REITs tax efficient. Shareholders may then enjoy preferential US.

Their dividend tax rate is much higher than dividends on stocks. The Tax Cuts and Jobs Act TCJA passed into law in 2017 further enhanced the tax efficiency. While REITs are less tax efficient than qualified dividend-paying US equities the extent of their inefficiency is overstated and misunderstood.

REITs are a tax-efficient diversified alternative to direct real estate ownership and investment. Tax Efficiency By holding a REIT in my Roth I can lower my tax rate on REIT income from 24 to 0. Theres another reason to put REITs in tax-advantaged accounts.

Real Estate Investment Trusts REITs are known as a tax efficient way to invest in real estate. Tax-Efficient Investing Strategies. If a mutual fund or ETF holds securities that have appreciated in value and sells them for any.

Since the REIT does not pay corporate taxes it has more profit to disburse to investors. We Advise More REITs than Any Other Professional Services Firm. For 2021 and 2022 you can contribute a total of 6000 to your.

Regarding the tax efficiency of REITs I think its worthwhile to point out that while they arent as tax efficient as stock index funds they are far more efficient than taxable bonds. Since REITs are required to distribute 90 of their annual taxable income to investors REITs are allowed to avoid taxation. REITs are a tax-efficient diversified alternative to direct real estate ownership and investment.

REITs offer incredible tax advantages. ETFs are vastly more tax efficient than competing mutual funds.

Reit Tax Advantages Why Investors Choose Reits Arrived Homes Learning Center Start Investing In Rental Properties

Guide To Reits Reit Tax Advantages More

Guide To Reits Reit Tax Advantages More

Sec 199a And Subchapter M Rics Vs Reits

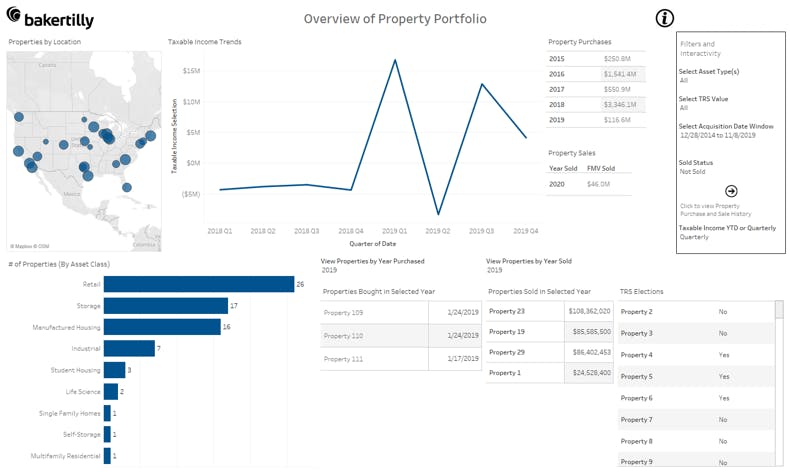

How Reits Can Leverage Financial Analytics And Dashboard Reporting To Drive Success Baker Tilly

Reit Tax Advantages Why Investors Choose Reits Arrived Homes Learning Center Start Investing In Rental Properties

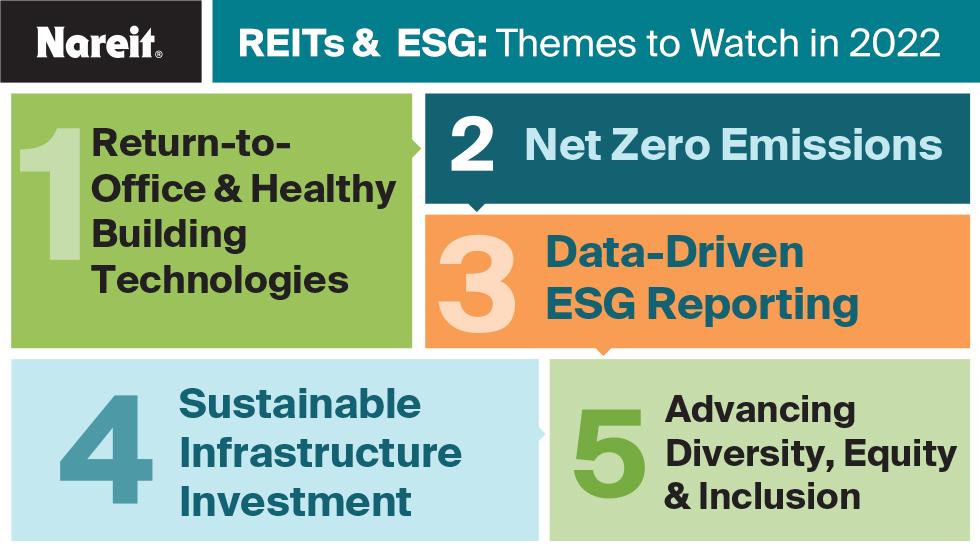

Reits Esg Themes To Watch In 2022 Nareit

What Is A Reit And Should I Invest In Them Personal Finance Club

Reits Or Rental Property All Season Financial

Pin By Rcs On Investor Awareness Words Of Wisdom Words Wisdom

What S The Deal With Reits Passive Investing Australia

Guide To Reits Reit Tax Advantages More

Reits Vs Real Estate Mutual Funds What S The Difference

Reits Offer Retirement Income And Much More This Retirement Life Investing For Retirement Retirement Portfolio Real Estate Investment Trust

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

What Is A Reit And Should I Invest In Them Personal Finance Club

Reit Tax Advantages Why Investors Choose Reits Arrived Homes Learning Center Start Investing In Rental Properties